Confession: I used to hate budgeting. My first attempt was a tangle of sticky notes, random receipts, and a horror show of half-filled Excel files. But fast forward to discovering the Google Sheets Personal Budget Planner, and suddenly my chaotic finances had a fighting chance. If you’ve ever wished budgets felt less like chores and more like clever mini-games for your wallet, you’re in the right place. Let’s talk about why this techy but surprisingly approachable planner might just be your financial gamechanger.

Why Regular Budgets Fail (and What Makes Google Sheets Different)

Let’s be honest—most traditional budgeting systems are just… boring. You start out with the best intentions, maybe even a fancy new notebook or an app you downloaded in a burst of motivation. But by week two? It’s gathering dust, and you’re back to guessing where your money went. Why does this happen? Because most budgets are too rigid, too static, and, frankly, too dull to stick with.

That’s where the Google Sheets Budget Template comes in and completely changes the game. Instead of forcing you into a one-size-fits-all mold, this dynamic budget planner adapts to your unique financial style. You get to set your own categories, adjust them on the fly, and see your progress in real time. No more feeling boxed in by someone else’s idea of what your budget should look like.

Dynamic Budget Planner Features That Actually Make Budgeting Fun

- Smart Income Allocation: Easily plan and track how your income is distributed across different expense and savings categories. No more guesswork—just clarity.

- Automated Budget Insights: Instantly see a clear, structured breakdown of your budget performance for every month and year. The feedback is immediate, so you always know where you stand.

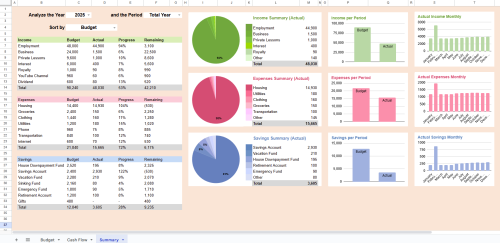

- Interactive Visual Dashboards: Watch your financial trends come to life with colorful graphs and charts. It’s not just about numbers—it’s about seeing your progress in a way that keeps you motivated.

- Full Customization: Whether you want to track daily coffee runs or annual subscriptions, you can personalize every aspect of your Google Sheets Budget Template. It grows with you, not against you.

Research shows that people are far more likely to stick with a budgeting system that’s interactive and visually engaging. That’s why the Google Sheets Budget Planner stands out. Its dynamic features and automated insights don’t just track your money—they help you understand it, optimize it, and actually enjoy the process.

Why Most Budgets Get Abandoned (and How Google Sheets Fixes That)

Traditional budgets are often static and inflexible. You set up categories once, and if your spending habits change, you’re stuck with a system that no longer fits. That’s a recipe for frustration—and for giving up. But with a Google Sheets Budget Template, you can:

- Rearrange categories as your priorities shift

- Instantly visualize your progress with automated dashboards

- Get real-time feedback that keeps you engaged

Here’s a personal anecdote: When I made the switch to a Google Sheets Budget Template, I stopped dreading those month-end reports. Instead of sifting through endless rows of numbers, I could glance at a dashboard and instantly see where I was winning—and where I needed to adjust. The colors and graphs made my progress obvious, and, honestly, a little bit addictive.

‘A tool that evolves with you keeps budgeting from becoming another dusty to-do.’ – Casey Taylor

With features like smart income allocation, automated budget insights, and a fully customizable layout, the Google Sheets Budget Planner isn’t just another tool—it’s your new financial sidekick. If you’re tired of giving up on budgets, maybe it’s time to try something that actually adapts to you.

Automated Insights and Interactive Dashboards: The ‘Cheat Codes’ for Your Money

Ever wish you could see exactly where your money is going—without the headache of manual calculations or endless scrolling through transactions? That’s where Automated Budget Insights and an Interactive Financial Dashboard in Google Sheets come in. Think of these features as your personal “cheat codes” for mastering your finances, making budgeting not just easy, but surprisingly fun.

Let’s be honest: most people put off budgeting because it feels overwhelming. But with a dynamic budget planner in Google Sheets, you get instant clarity. The planner automatically pulls your income, expenses, and savings into slick, real-time summaries. No more guesswork. No more end-of-month surprises. You see the full picture—every dollar, every category, every month.

Here’s the magic: the Interactive Financial Dashboard updates itself every month and year. As soon as you enter your latest numbers, the dashboard transforms them into colorful charts and graphs. Suddenly, bland rows of numbers become visual stories. You can spot spending trends, celebrate progress, or catch problem areas with just a glance. Research shows that automated insights and dashboard features not only boost budgeting accuracy but also make users more engaged with their finances. When you see your progress in living color, you want to keep going.

And it’s not just about pretty visuals. These Budget Tracking Features are practical, too. Imagine this: you’re reviewing your dashboard and notice a spike in your “subscriptions” category. You dig in and—surprise!—find a gym membership you forgot to cancel, and even a double-charged fee. (Yes, that really happened to me.) With automated insights, you catch these sneaky expenses before they drain your wallet.

What sets this Google Sheets planner apart is its structured approach. You get:

- Automated breakdowns of your budget performance for every month and year

- Three simple spreadsheets that manage your full financial history, detailed analysis, and easy-to-read summaries

- A dashboard that evolves with you—no need to build anything from scratch

It’s all about turning raw data into actionable knowledge. As you track your finances month after month, you build a living history of your habits. You can review past spending, spot patterns, and plan smarter for the future. The best part? You don’t need to be a spreadsheet whiz. The planner is designed for simplicity and flexibility, so you can customize it to fit your unique needs.

Good data visualization is the difference between confusion and clarity. – Priya Sachdev

With automated budget insights and an interactive dashboard, you’re not just tracking numbers—you’re unlocking the story of your money. And when you can actually see your progress, budgeting becomes less of a chore and more of a game you want to win. That’s the power of a smart, Google Sheets-based budget planner.

Customization: Making the Planner Truly Yours (Yes, Even If You Hate Spreadsheets)

Let’s be honest—most budgeting tools feel like they’re designed for someone else’s life. Rigid categories, bland layouts, and formulas that make your eyes glaze over. But what if you could have a Customizable Budgeting Tool that actually fits your unique lifestyle, quirks, and even your love for spontaneous coffee runs? That’s exactly what the Google Sheets Personal Budget Planner delivers. And yes, it’s surprisingly fun—even if spreadsheets usually make you want to run for the hills.

With this planner, you’re in the driver’s seat. Want to track a ‘coffee adventures’ fund or set a goal for your next big trip? Go for it. You can add, rename, or color-code categories with just a few clicks. Prefer your expenses grouped by week instead of month? No problem. The planner’s flexibility means you can tweak calculations, rearrange layouts, and even add your own personal flair. Suddenly, budgeting isn’t a chore—it’s a creative process. And research shows that people are far more likely to stick with a budget when it feels personal and adaptable, not rigid or one-size-fits-all.

But what if you’re not a spreadsheet whiz? That’s where the Step-by-step Budget Planner Tutorial comes in. Linked right inside the planner, these easy-to-follow guides walk you through every feature, from setting up your first budget to unlocking advanced insights. You’ll go from spreadsheet-phobe to budget ninja in no time. The tutorials are designed for all skill levels, so whether you’re a total beginner or a seasoned number cruncher, you’ll find the support you need—without any intimidation.

And let’s talk about the features that make this tool truly stand out. The Smart Income Allocation Tool helps you plan and track exactly how your income is distributed across savings, bills, and those little joys that make life sweet. Automated insights break down your budget performance month by month, while an interactive dashboard lets you visualize trends at a glance. You can even store and review your financial history, making it easy to spot progress (or catch bad habits before they spiral).

It’s all about making the planner feel like it was built for you. Add your own goals, adjust visuals to match your style, and set up categories that reflect your real spending—not someone else’s idea of what matters. As Sara Montalvo puts it,

“A budget that bends with your lifestyle is the only kind you’ll stick with.”

And if you’re worried about commitment, don’t be. For just $39.99, you get instant access via a quick PDF download (just 123KB), and there’s a 60-day money-back guarantee—no questions asked. So you can try it risk-free and see how a truly customizable budget can change your financial game.

Ready to stop procrastinating and start building a budget that actually works for you? With the Google Sheets Personal Budget Planner, you’re not just tracking numbers—you’re designing a financial future that feels as unique as you are. Give it a try, and discover how fun (yes, fun!) budgeting can be.

TL;DR: If regular budgeting puts you to sleep, you owe it to yourself to try a Google Sheets-based planner. It’s customizable, instantly insightful, and yes—kinda fun.